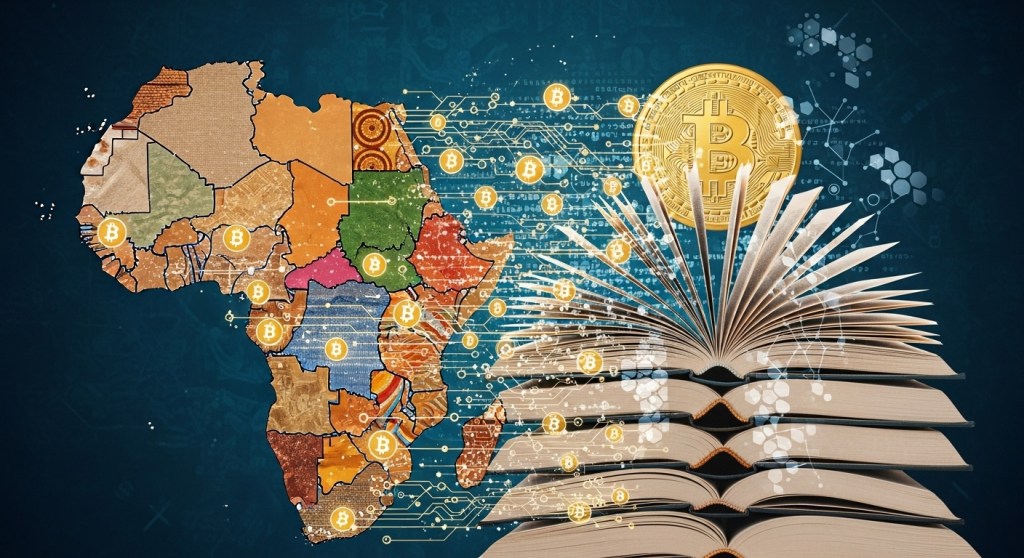

What a South African Study Reveals About Blockchain’s Potential to Support Africa’s Unbanked

Using Blockchain Technology in Providing Mobile Financial Services to Alleviate Financial Exclusion in South Africa by Budree et al. (2023) examines how blockchain could expand mobile financial services to the country’s unbanked.

The study outlines a sharp divide: 54% of adults in developing countries have bank accounts, compared to 94% in OECD nations. In South Africa, 27% remain excluded, and over 30 million live in poverty. Less than 30% of low-income adults hold formal accounts. High fees, poor connectivity, and lack of identity documents keep many reliant on cash, despite growing interest in digital financial tools.

Rather than relying on assumptions, it draws from real-world interviews and industry insight, offering a clearer view of how people engage with these technologies. Through interviews with industry experts, startups, and blockchain practitioners, the study finds consensus that blockchain can lower barriers.

Benefits include reduced costs by removing intermediaries, better recordkeeping, faster cross-border transactions, and the potential for digital identities. Blockchain’s immutability was seen as useful for building credit histories for informal workers.

The study also emphasizes the equal treatment enabled by blockchain systems. As one participant put it, “I can do a $1 transaction… and get treated no differently from somebody doing a $1 billion transaction”. A contrast to how traditional banks prioritize wealthier clients.

Yet, the research remains grounded. Blockchain’s complexity can be a hurdle, and usability remains a major challenge. Without understanding rural users, solutions fall flat. High data costs and weak connectivity make adoption even harder, making simple tools like USSD essential. USSD uses basic phone codes, needs no internet, and works on any device.

This makes the research timely. While the barriers remain, Bitcoin tools have improved. Machankura, a USSD-based wallet, lets users send and receive bitcoin via *8333#, with no smartphone or internet. Active in 9 African countries, it turns promise into practical access.