- Stablecoin Spotlight: Reports and Data

- Recent Policy and Oversight Trends

- Bitcoin’s Counterpoint

- Conclusion

Stablecoins, designed to maintain a stable value relative to a reference asset such as the U.S. Dollar, have become a central feature of Africa’s digital asset ecosystem. Their ease of use and dollar-pegged stability have made them attractive for payments, remittances, and savings across the continent.

Industry reports highlight key drivers to include hedging against inflation, navigating foreign exchange shortages, enabling cross-border trade, supporting payrolls, and accessing cheaper crypto payment rails. However, this convenience comes with systemic risks tied to their design, collateralization, and heavy reliance on foreign monetary infrastructure.

These risks extend beyond crypto markets, reinforcing dollar hegemony and raising questions about Africa’s long-term financial sovereignty. Understanding them is critical for policymakers, regulators, and industry stakeholders as stablecoins increasingly dominate transaction volumes across Sub-Saharan Africa.

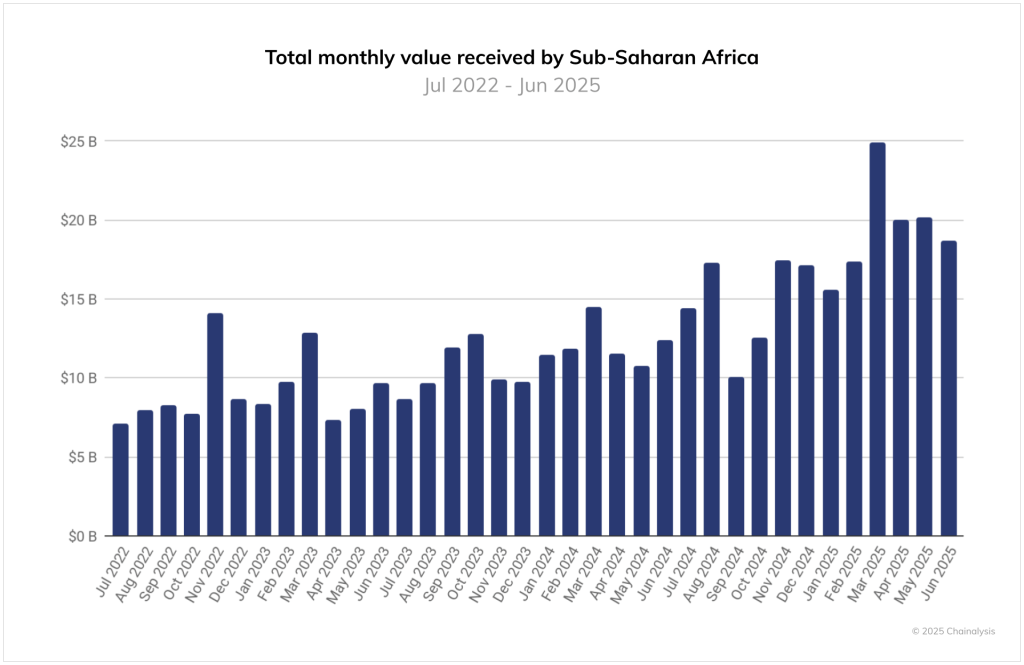

Recent data underscores this trend: total monthly value received in Sub-Saharan Africa has risen sharply, with stablecoins playing an outsized role in driving adoption. The growing scale of these inflows demands urgent reflection on whether stablecoins represent a bridge to innovation or a reinforcement of old dependencies.

Stablecoin Spotlight: Reports and Data

Found that 99% of Yellow Card transactions are stablecoins, with USDT dominating. Drivers include inflation, FX shortages, payrolls, and cross-border trade. While 70% of stablecoin users rely on them for personal purposes such as remittances and savings, 30% now employ them for business operations. The report indicates that adoption is driven less by enthusiasm for the technology and more by necessity.

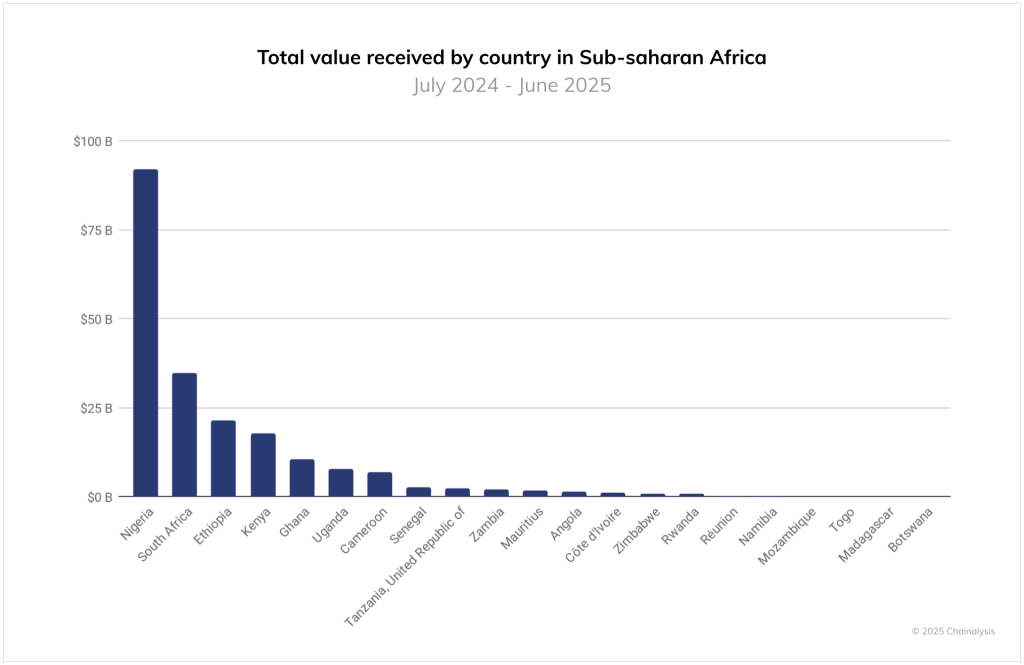

- “Nigeria: USD 22B stablecoin transactions (2023–24)”

Warns against pegging stablecoins to fragile currencies. Nigeria’s naira has lost 70% of its value since 2020, cNGN lacks reserve audits, and growth is incentive-driven rather than organic.

In emerging economies, Global stablecoins risk weakening confidence in local currencies, undermining central bank control of monetary policy, and exposing fragile financial systems to external shocks echoing the same vulnerabilities seen in dollarized economies. (Melachrinos & Pfister, 2020)

On-chain activity reached USD 205B (July 2024–June 2025), a 52% YoY increase. Stablecoins dominate both small retail transfers and large-scale trade settlements linking Africa with Asia and the Middle East.

Market Snapshot (Chainalysis 2025)

- Global stablecoin market cap grew from USD 5B (2020) → USD 230B (2025)

- Global stablecoin volume in 2024: USD 15.6T (larger than Visa & Mastercard combined)

- Africa: 43% of crypto flows are stablecoins.

- Other 57%: The reports confirm it’s made up of Bitcoin, Ethereum, and other altcoins but no further numeric breakdown is provided.

- Nigeria: USD 22B stablecoin transactions (2023–24)

- South Africa: Stablecoins have overtaken Bitcoin usage

Recent Policy and Oversight Trends

- Nigeria: President Tinubu ordered regulators to closely monitor digital assets. Oversight is framed as a defense against instability and uncontrolled monetary flows.

- Kenya: Former Prime Minister Raila Odinga announced the planned launch of the “Kenya Token”, reflecting political momentum around national digital currencies.

- Zanzibar: Signed an MoU with Tether to advance blockchain adoption and digital asset education, signaling an openness to public–private collaboration.

Bitcoin’s Counterpoint

While stablecoins currently dominate usage, Bitcoin remains the long-term foundation for monetary sovereignty. In South Africa, stablecoin transactions have overtaken Bitcoin, reflecting demand for short-term stability.

Bitcoin is governed by code, not institutions. Its monetary policy is fixed, with new coins issued through mining rewards that halve roughly every four years until the 21 million cap is reached. Enforced through decentralized consensus, this system prevents arbitrary inflation or manipulation.

Unlike stablecoins, which rely on issuers and collateral reserves, Bitcoin is both the asset and the network. Its peer-to-peer design allows anyone to verify and transact without permission, ensuring grassroots participation and individual sovereignty.

Conclusion

Stablecoins have become Africa’s practical crypto tool for remittances, trade, and survival under inflationary pressure. Their dollar-pegged stability offers short-term relief, but risks are mounting.

Fragile experiments such as Nigeria’s cNGN highlight the impending dangers of unstable pegs, while IMF reports express concern that stablecoins could pose financial stability, regulatory, and legal risks—especially in markets with weak institutions—calling for better monitoring, regulation, and safeguards.

Policymakers are already responding. In South Africa, the Revenue Service has tightened tax oversight of crypto traders, while Nigeria’s SEC has classified stablecoins as securities. Meanwhile, initiatives such as Kenya’s proposed “Kenya Token” and Zanzibar’s digital asset education programs reflect a mix of experimentation and caution.

Locally pegged coins may carry political appeal, but they risk collapse in fragile economies. Some have called for Africa to issue its own stablecoins to capture yield benefits; however, the continent faces structural challenges, including high inflation, weak currencies, and low industrialization. All of this unfolds against the backdrop of Africa being the most expensive region in the world for sending remittances, underscoring the urgent need for affordable and resilient financial rails.

History also offers a warning. TerraUSD (UST) collapsed in 2022, wiping out USD 18 billion in value; USDC briefly de-pegged during the SVB crisis in 2023; and USN imploded in 2022. A dollar peg alone does not guarantee stability.

Africa now faces a strategic choice of rails to secure its financial sovereignty. USD-backed stablecoins provide short-term convenience but remain issuer-dependent. The U.S. dollar itself has lost nearly 25% of its purchasing power since 2020, with an additional 10–11% decline against major currencies in 2025. This raises serious questions about the long-term reliability of dollar-backed stablecoins as Africa’s financial foundation.

To emphasize, stablecoins aren’t just a local African issue; they’re tied to global power struggles, U.S. debt policy, and dollar dominance. Analysts argue that stablecoins may become “a quasi-demand sink for U.S. debt“, especially in a world where foreign demand for Treasuries is weakening.

Treasury reports confirm that stablecoin reserves may include cash, bank deposits, repurchase agreements, or short-term U.S. government securities. The demand to trade digital assets like Bitcoin largely priced in dollars has fueled global use of stablecoins, which now serve as a “Trojan horse for U.S. debt,” reinforcing dollar influence even in regions striving for financial independence.

By early 2025, Tether held nearly $100 billion in Treasury bills (around 1.6% of the market) placing it alongside nation-states as a top creditor. This demand has lowered short-term yields, saving US billions in annual interest costs. In this way, stablecoins are no longer just pegged to the dollar; they are helping underwrite it.

If Africa’s goal is merely short-term survival, stablecoins can serve. But if the aim is departure from traditional finance and real sovereignty, then the path must include greater Bitcoin education, awareness, and adoption — ensuring the continent does not trade one dependency for another.

More than a financial tool, Bitcoin reflects natural principles of human rights: the right to freely transact, the right to protect savings from debasement, and the right to participate in a system not subject to centralized control.

Governed by code rather than institutions, Bitcoin is rapidly maturing, offering the only incorruptible, decentralized, and trustless system for true monetary independence.

In the absence of a unified continental currency, Bitcoin presents Africans with a path toward monetary sovereignty, protection from inflation, and freedom from centralized control.